2016 was a big year for paid search. Q4 of 2016 provides a glimpse of trends expected to continue in 2017, especially in terms of mobile search and shopping ads. Find out which paid search trends to consider when mapping out your strategy.

Paid Search Trends in Q4 2016

Strong Quarter for Paid Search Adverting Spending

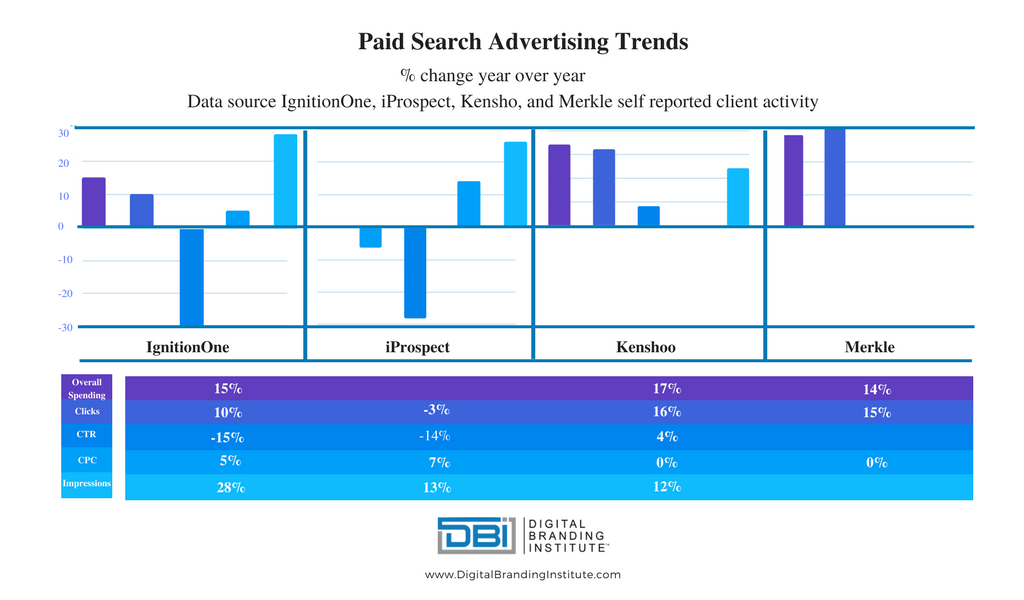

IgnitionOne, a marketing optimization platform, iProspect, a digital marketing agency, Kenshoo, another marketing optimization platform, and Merkle, a performance marketing agency, have released their Q4 reports on their client’s paid search trends.

Based on their clients’ activity, Q4 was a strong quarter for paid search advertising spending. IgnitionOne (+15%), Kenshoo (17%), and Merkle (14%) all report a double-digit increase in their clients’ spending.

Impressions also had a double-digit increase. IgnitionOne reports an increase of 28% year-over-year, iProspect an increase of 13% year-over-year, and Kenshoo an increase of 12% year-over-year, while Merkle did not report for this metric.

Weak Quarter for click-through rates (CTR) and costs-per-clicks (CPC)

While overall spending and impressions were up year-over-year, CTR and CPC did not have a strong 2016 Q4.

Both IgnitionOne (-15%) and iProspect (-14%) reported double-digit declines, while Kenshoo only reported a 4% growth.

This growth could be explained because Kenshoo looked at global clients, as opposed to IgnitionOne and iProspect, which only looked at the U.S. Merkle did not report for this metric.

CPC also had a weak quarter. IgnitionOne (5%) and iProspect (7%) only reported mild growth year-over-year, and Merkle and Kenshoo were flat.

Mobile and Digital Data To Note

Q4 was also a really strong quarter for mobile.

All told, smartphones grew to account for 47% share of paid search clicks across search engines, per the analysis, a sizable increase from one-third of clicks in the year-earlier period.

While Merkle did not report their CTR and impressions metrics, they also released data that indicates that 51% of Google search ad clicks came from smartphones.

This is interesting as it is the first time smartphones have taken the majority share. As we become more and more dependent on our smartphones, this number will most likely continue to increase.

This data is supported by findings from IgnitionOne, who saw mobile search spend rise 69%, and tablet search spend dramatically decrease.

iProspect found that mobile shopping spend was at a record high in Q4 2016.

Merkle’s data also confirms these results. They found that one of the largest impacts on Q4 performance was the 41% spend increase for shopping ads.

As consumers get more and more comfortable shopping from their phones, this number will continue to build.

This does not just include B2C business, but B2B advertisers are also moving heavily over to mobile search.

Kenshoo also found that desktop ad spending was flat year-over-year.

Perhaps not so surprising was that political advertising spend was higher in Q4.

MarketingCharts illustrated that 14.4% of total spending, digital political ads were 8.5x higher than the spending in 2012.

FYI this is now equal to the amount of ad spending on print and radio combined.

Have you seen similar results with your paid search activity? Please share in the comments!